Chase Bank Checks: Your Ultimate Guide To Secure And Reliable Transactions

When it comes to banking, Chase Bank has been a trusted name for decades. Whether you're managing personal finances or running a business, understanding how Chase Bank checks work is crucial. In this article, we'll dive deep into everything you need to know about Chase Bank checks, from ordering and depositing to troubleshooting common issues. So, let's get started!

Let's face it, checks might seem old-school, but they're still widely used in various financial transactions. Chase Bank checks offer convenience, security, and reliability for both senders and receivers. Whether you're paying bills, making a large purchase, or transferring funds, knowing how to handle Chase Bank checks properly is essential.

This guide is designed to provide you with all the information you need to navigate the world of Chase Bank checks. From ordering checks to understanding security features, we'll cover it all. So, whether you're a seasoned user or new to the process, this article has got you covered.

- Ekta Kapoors Dating History A Deep Dive Into Her Love Life And Relationships

- Branded Bills Vs Melin The Ultimate Showdown Unveiled

Understanding Chase Bank Checks

What Are Chase Bank Checks?

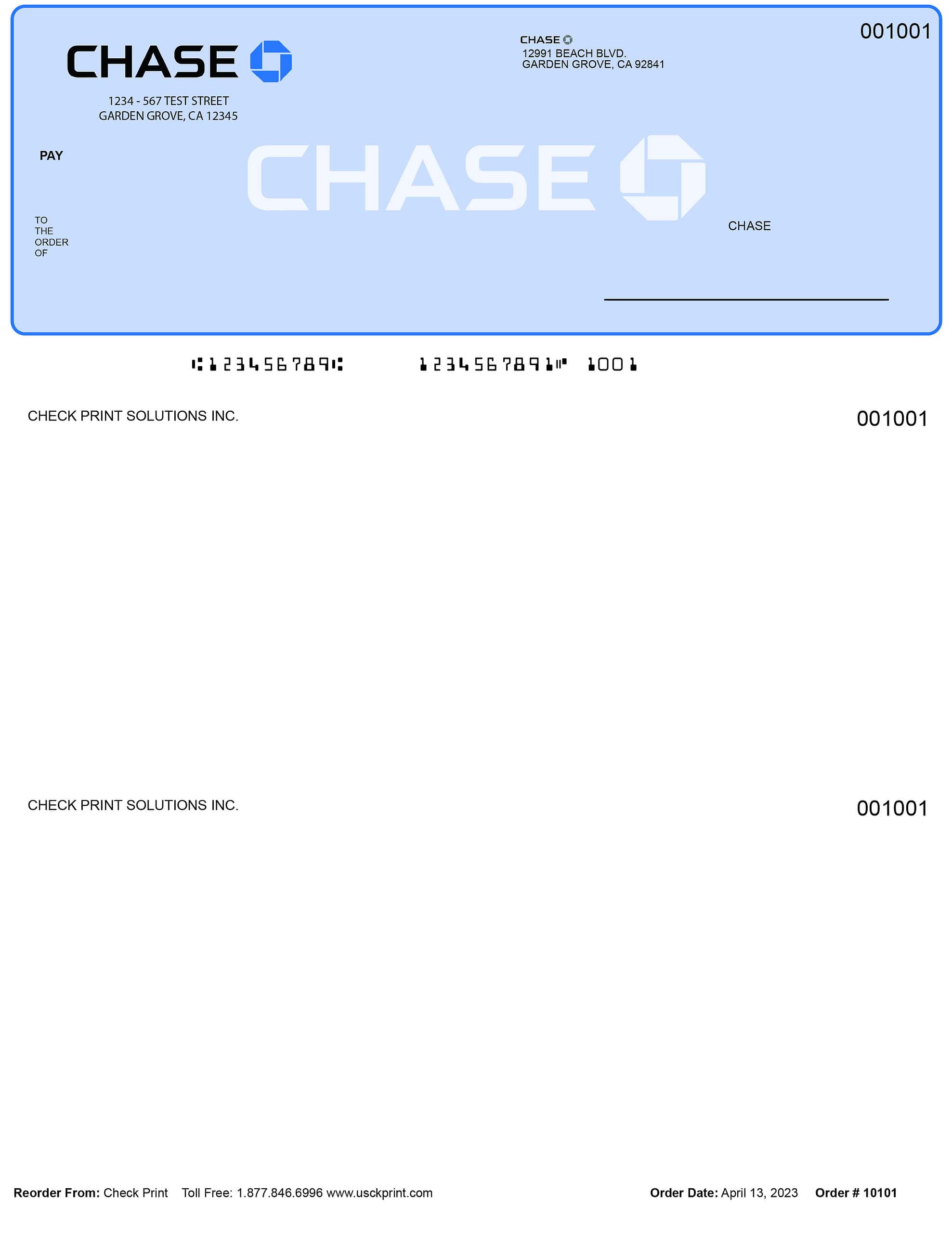

Chase Bank checks are official documents issued by JPMorgan Chase, one of the largest financial institutions in the U.S. These checks are used to transfer money from one account to another. They come with advanced security features to prevent fraud and ensure authenticity.

For instance, Chase Bank checks include watermarks, security threads, and unique codes that make them difficult to counterfeit. This level of security is what sets Chase apart from other banks. Plus, Chase offers both personal and business checks, catering to a wide range of customer needs.

Why Choose Chase Bank Checks?

There are several reasons why Chase Bank checks are a popular choice among customers:

- Carlos Torres Net Worth The Untold Story Of Success And Wealth

- Emily Austin Partner The Ultimate Guide To Her Life Career And Achievements

- Security features that protect against fraud

- Easy ordering process through online platforms

- Wide acceptance across businesses and institutions

- Reliable customer support for troubleshooting issues

These advantages make Chase Bank checks a dependable option for anyone looking to conduct financial transactions safely and efficiently.

Ordering Chase Bank Checks

Ordering Chase Bank checks is a straightforward process. You can do it online, through the Chase mobile app, or by visiting a local branch. Here's a step-by-step guide to help you get started:

How to Order Checks Online

First, log in to your Chase online account. Navigate to the "Order Checks" section and select the type of check you need. You can choose from personal checks, business checks, or duplicate checks, depending on your requirements. Then, customize your order by selecting design options and adding any special instructions.

Once you've finalized your order, review the details and submit it. Your checks will be delivered to your address within a few business days. It's that simple!

Depositing Chase Bank Checks

How to Deposit a Chase Bank Check

Depositing a Chase Bank check is just as easy as ordering one. You can deposit checks through the Chase mobile app, ATMs, or by visiting a branch. Here's how you can do it using the mobile app:

- Open the Chase mobile app and log in to your account

- Select the "Deposit" option and choose the account you want to deposit into

- Take a clear photo of the front and back of the check

- Confirm the details and submit the deposit

Within minutes, the funds will be added to your account, subject to Chase's deposit policies.

Security Features of Chase Bank Checks

Security is a top priority for Chase Bank. Their checks come equipped with several features to prevent fraud and ensure authenticity:

- Watermarks that are visible when held up to light

- Security threads embedded within the paper

- Unique codes that can be verified by Chase

- Special ink that changes color when exposed to heat

These features make it extremely difficult for counterfeiters to replicate Chase Bank checks, giving customers peace of mind when conducting transactions.

Common Issues with Chase Bank Checks

Troubleshooting Tips

Even with advanced security features, issues can arise when using Chase Bank checks. Here are some common problems and how to resolve them:

- Check not clearing: If your check isn't clearing, contact Chase customer support to verify the status of the transaction.

- Missing checks: If your checks haven't arrived, report it immediately to Chase so they can investigate and resend them if necessary.

- Incorrect information: If you notice errors on your checks, contact Chase to request a replacement order.

Chase offers 24/7 customer support to assist with any issues you may encounter, ensuring a smooth experience for all customers.

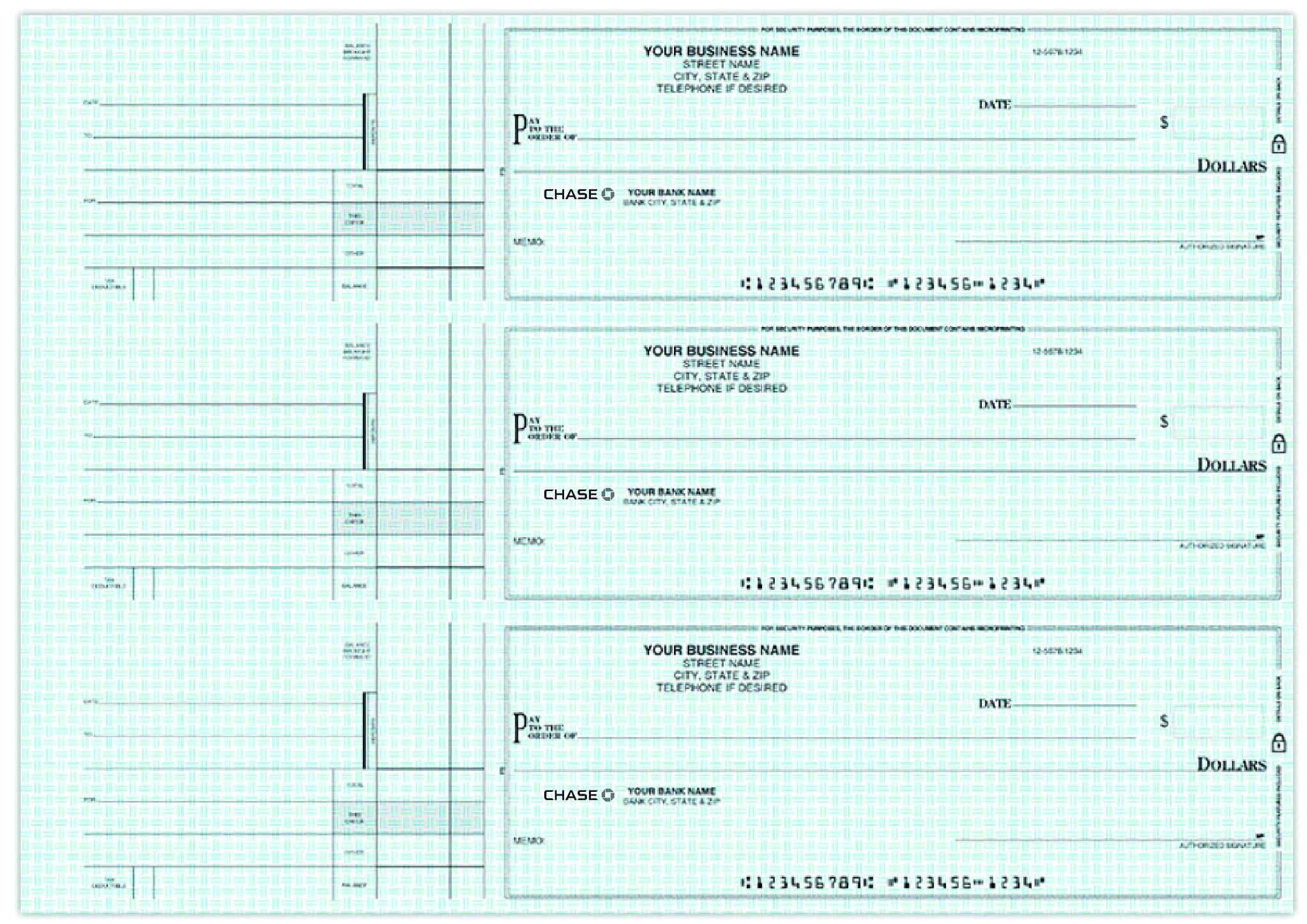

Using Chase Bank Checks for Business Transactions

For businesses, Chase Bank checks are an essential tool for managing finances. They offer a secure and reliable way to pay suppliers, employees, and vendors. Here are some tips for using Chase Bank checks effectively in a business setting:

Best Practices for Business Checks

- Always verify the recipient's information before issuing a check

- Keep track of all checks issued and their statuses

- Use duplicate checks for record-keeping purposes

- Regularly review bank statements to ensure all transactions are accurate

By following these best practices, businesses can minimize the risk of errors and fraud when using Chase Bank checks.

Chase Bank Checks vs. Other Payment Methods

While checks are still widely used, they do have their pros and cons compared to other payment methods. Here's a comparison of Chase Bank checks with other popular options:

Pros and Cons of Chase Bank Checks

- Pros: Secure, widely accepted, and easy to track

- Cons: Can take longer to clear compared to electronic payments

Ultimately, the choice of payment method depends on your specific needs and preferences. For those who prioritize security and reliability, Chase Bank checks remain a top choice.

How to Verify Chase Bank Checks

Verifying the authenticity of a Chase Bank check is crucial to prevent fraud. Here's how you can do it:

Steps to Verify a Chase Bank Check

- Check for visible security features such as watermarks and security threads

- Verify the check's details with Chase customer support

- Look for any signs of tampering, such as smudged ink or altered information

By taking these steps, you can ensure that the Chase Bank check you're dealing with is genuine and safe to use.

Tips for Managing Chase Bank Checks

Managing Chase Bank checks effectively can save you time and money. Here are some tips to help you stay organized:

Staying Organized with Checks

- Keep a record of all checks issued and their purposes

- Store unused checks in a secure location

- Regularly review your bank statements for any discrepancies

By following these tips, you can avoid common pitfalls and make the most out of your Chase Bank checks.

Conclusion

In conclusion, Chase Bank checks offer a secure, reliable, and convenient way to conduct financial transactions. From ordering and depositing to troubleshooting issues, this guide has provided you with all the information you need to navigate the world of Chase Bank checks successfully.

We encourage you to share your thoughts and experiences in the comments section below. Your feedback helps us improve and provide even better content in the future. And don't forget to check out our other articles for more insights into the world of finance and banking!

Table of Contents

- Understanding Chase Bank Checks

- What Are Chase Bank Checks?

- Why Choose Chase Bank Checks?

- Ordering Chase Bank Checks

- How to Order Checks Online

- Depositing Chase Bank Checks

- How to Deposit a Chase Bank Check

- Security Features of Chase Bank Checks

- Common Issues with Chase Bank Checks

- Troubleshooting Tips

- Using Chase Bank Checks for Business Transactions

- Best Practices for Business Checks

- Chase Bank Checks vs. Other Payment Methods

- Pros and Cons of Chase Bank Checks

- How to Verify Chase Bank Checks

- Steps to Verify a Chase Bank Check

- Tips for Managing Chase Bank Checks

- Staying Organized with Checks

- Conclusion

Detail Author:

- Name : Eliseo Walsh

- Username : reece41

- Email : grady.jasen@hotmail.com

- Birthdate : 1986-03-19

- Address : 69307 Berge Lodge West Christophe, MN 96834-1217

- Phone : 1-757-990-0744

- Company : Willms Ltd

- Job : Rolling Machine Setter

- Bio : Voluptatem exercitationem sed velit facere vel et. Officia quos qui aliquam. Amet dolores praesentium deleniti maxime non et totam.

Socials

instagram:

- url : https://instagram.com/bashirian2013

- username : bashirian2013

- bio : Quae dolor sed ab ut et. Eaque et doloremque et optio ut. Non omnis ut velit qui amet sint.

- followers : 1752

- following : 2885

twitter:

- url : https://twitter.com/kaitlyn_id

- username : kaitlyn_id

- bio : Et est laudantium qui non. Sit aut vitae adipisci quis temporibus ex quod. Qui consequatur aut minima nobis ut est.

- followers : 3623

- following : 2856

tiktok:

- url : https://tiktok.com/@kaitlyn.bashirian

- username : kaitlyn.bashirian

- bio : Soluta ea iure assumenda voluptas fugiat explicabo.

- followers : 1626

- following : 1590

facebook:

- url : https://facebook.com/kaitlyn_dev

- username : kaitlyn_dev

- bio : Quo eligendi amet non quisquam ipsum praesentium in.

- followers : 1986

- following : 525