What Are The Key Debates On China Online Education Group Stock? A Deep Dive

China’s online education market has been a hot topic in the global investment world, especially when it comes to China Online Education Group stock. If you’ve been following the trends, you know this sector is packed with potential but also comes with its fair share of challenges. The debates around the company’s stock are intense, and investors are torn between optimism and caution. So, what’s really going on here?

From regulatory changes to financial performance, there’s a lot to unpack. If you’re looking to make an informed decision about China Online Education Group stock, you’ve come to the right place. This article will break down the key debates, trends, and controversies surrounding this company. Let’s dive in!

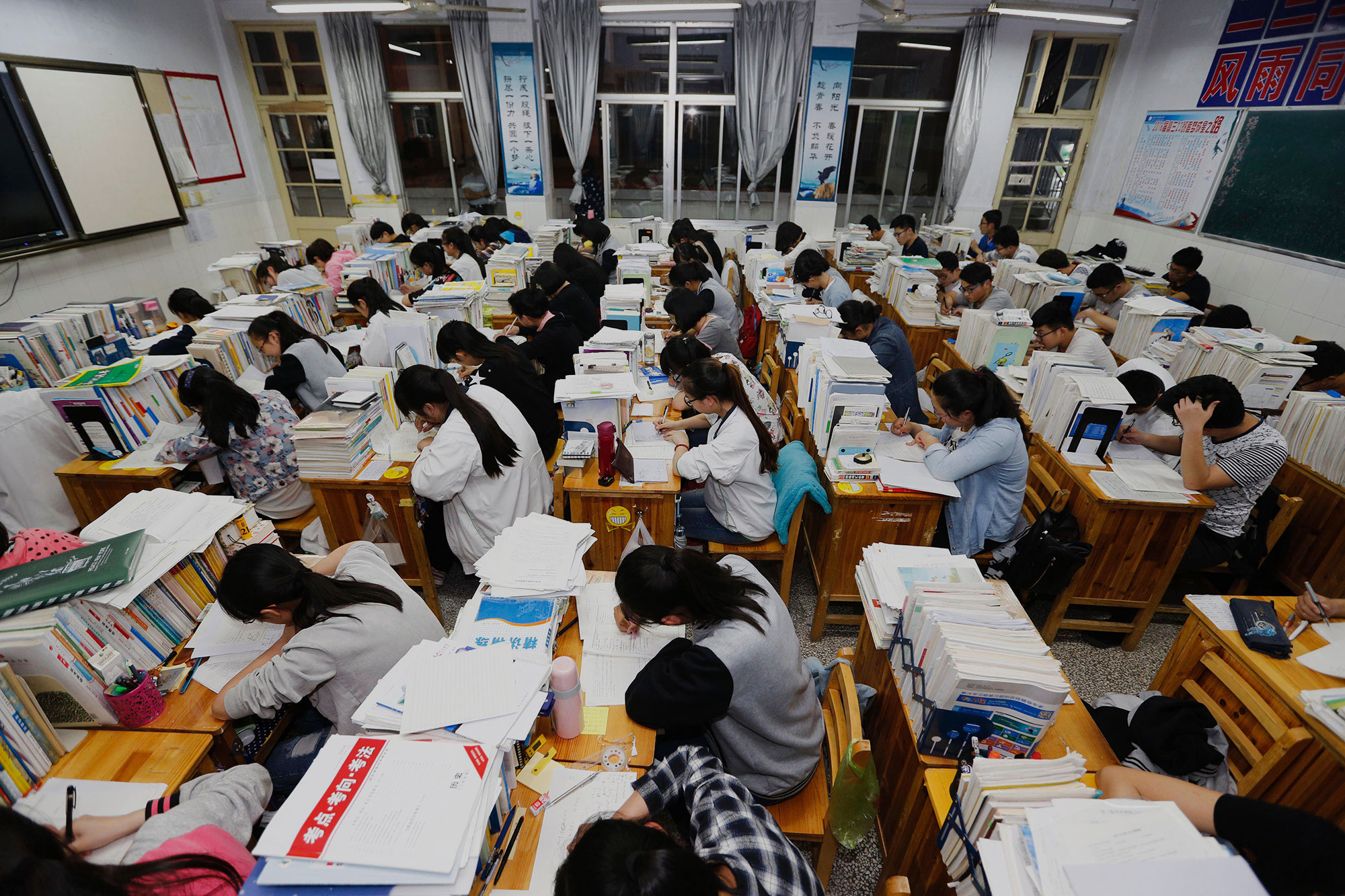

Before we get too deep, let’s set the stage. Online education in China has grown exponentially over the past decade, driven by increasing internet penetration and a growing middle class eager to invest in their children’s futures. But with great growth comes great scrutiny. Investors are asking tough questions about the sustainability of this market and the company’s ability to navigate the ever-changing landscape. Are you ready to explore the debates? Let’s go!

- Is Shirley Henderson Married Discover Her Personal Life And Journey

- Shane Harper And Samantha Boscarino The Love Story Thatrsquos Captured Hearts Worldwide

Understanding China Online Education Group Stock

First things first, let’s clarify what we’re talking about. China Online Education Group is one of the leading players in the online education sector in China. The company offers a wide range of educational services, from K-12 tutoring to professional development courses. Its stock has been a rollercoaster ride for investors, with dramatic ups and downs driven by both internal and external factors.

One of the key debates revolves around the company’s business model. Is it sustainable in the long run? Critics argue that the intense competition and regulatory pressures could derail its growth trajectory. On the other hand, supporters believe that the company’s innovative approach and strong brand presence will help it weather the storm. What do you think?

Key Drivers of Growth in the Online Education Market

Let’s take a closer look at the factors driving the growth of China’s online education market. The first and most obvious factor is the increasing demand for quality education. Parents in China are willing to spend big bucks on their children’s education, and online platforms offer a convenient and cost-effective solution.

- Matthew Hollgarth The Untold Story Of A Rising Star In The Entertainment World

- Amy Pricefrancis Family A Closer Look At The Life Legacy And Family Roots

- **Increased Internet Penetration**: With more people gaining access to the internet, the reach of online education platforms has expanded significantly.

- **Government Support**: The Chinese government has been actively promoting digital learning as part of its broader education reform agenda.

- **Technological Advancements**: Innovations in AI, big data, and cloud computing have enhanced the learning experience, making it more interactive and personalized.

However, not all is sunshine and rainbows. The market is highly competitive, and companies are constantly vying for market share. This brings us to the next big debate – can China Online Education Group maintain its edge in such a crowded space?

The Regulatory Landscape: A Double-Edged Sword

One of the most significant debates surrounding China Online Education Group stock is the impact of government regulations. In recent years, the Chinese government has introduced a series of measures aimed at regulating the education sector. While these regulations are designed to protect consumers and ensure quality, they have also created uncertainty for investors.

For instance, the government has imposed strict limits on advertising and marketing practices, which could affect the company’s ability to attract new students. Additionally, there are concerns about the sustainability of the business model under these new rules. Some analysts believe that the company may need to adapt its strategies to stay compliant, which could lead to higher costs and lower profitability.

How Are Investors Reacting to Regulatory Changes?

Investor sentiment has been mixed in response to the regulatory changes. Some see them as a necessary step to ensure the long-term health of the industry, while others view them as a threat to profitability. The stock price has been volatile, reflecting this uncertainty.

Here are a few key points to consider:

- **Short-Term Pain for Long-Term Gain**: Many investors believe that the regulatory changes will benefit the industry in the long run by creating a more level playing field.

- **Adapt or Die**: Companies that fail to adapt to the new regulations may struggle to survive, while those that innovate and comply could thrive.

- **Market Sentiment**: The stock market often overreacts to regulatory news, leading to sharp price fluctuations.

So, where does this leave China Online Education Group? Only time will tell, but one thing is certain – the company will need to be agile and innovative to navigate these challenges.

Financial Performance: The Numbers Don’t Lie

When it comes to investing, the numbers are crucial. Let’s take a look at China Online Education Group’s financial performance to see how it stacks up against its competitors.

Revenue growth has been impressive, with the company reporting double-digit increases in recent quarters. However, profitability has been a concern, with operating margins squeezed by intense competition and rising costs. Analysts are divided on whether the company can turn things around and deliver sustainable profits in the future.

Key Financial Metrics to Watch

Here are some key financial metrics that investors should keep an eye on:

- **Revenue Growth**: Is the company continuing to expand its user base and increase its revenue streams?

- **Operating Margins**: Can the company improve its profitability by cutting costs and optimizing its operations?

- **Cash Flow**: Does the company have enough cash on hand to sustain its operations and invest in growth?

These metrics will be critical in determining the long-term viability of China Online Education Group stock. Investors need to weigh the risks and rewards carefully before making a decision.

Competition in the Online Education Space

The online education market in China is fiercely competitive, with numerous players vying for market share. Some of the key competitors include New Oriental Education & Technology Group, TAL Education Group, and VIPKid. Each of these companies brings its own strengths and weaknesses to the table, making it a complex landscape for investors to navigate.

China Online Education Group has carved out a niche for itself by focusing on innovative teaching methods and leveraging technology to enhance the learning experience. However, the company faces stiff competition from larger, more established players that have deeper pockets and broader reach.

What Sets China Online Education Group Apart?

Here are a few factors that differentiate China Online Education Group from its competitors:

- **Technology-Driven Solutions**: The company has invested heavily in AI and big data to create personalized learning experiences for its students.

- **Strong Brand Presence**: With a reputation for quality and innovation, the company has built a loyal customer base.

- **Focus on User Experience**: The company prioritizes user satisfaction, ensuring that its platforms are easy to use and engaging.

While these factors give the company a competitive edge, they also come with challenges, such as high R&D costs and the need for constant innovation.

Market Trends and Future Outlook

Looking ahead, the online education market in China is expected to continue growing, driven by increasing demand and technological advancements. However, the landscape is likely to become even more competitive, with new entrants and established players vying for market share.

Investors are keen to know whether China Online Education Group can capitalize on these trends and maintain its position as a leader in the industry. The company’s ability to adapt to changing market conditions and regulatory requirements will be crucial in determining its success.

Predictions for the Future

Here are a few predictions for the future of China Online Education Group:

- **Increased Focus on AI**: The company is likely to double down on its investments in AI and machine learning to enhance the learning experience.

- **Expansion into New Markets**: As the domestic market becomes more saturated, the company may look to expand into international markets.

- **Sustainability as a Priority**: With growing concerns about the environment, the company may adopt more sustainable practices to appeal to eco-conscious consumers.

These trends could shape the future of the company and its stock performance. Investors should keep a close eye on these developments to make informed decisions.

Investor Sentiment: What Are People Saying?

Investor sentiment plays a crucial role in determining stock prices. Let’s take a look at what people are saying about China Online Education Group stock.

On social media platforms like Reddit and Twitter, investors are divided on the company’s prospects. Some are bullish, pointing to its strong brand presence and innovative approach. Others are bearish, citing concerns about regulatory risks and financial performance.

Key Points from Investor Discussions

Here are a few key points from recent investor discussions:

- **Regulatory Risks**: Many investors are concerned about the impact of government regulations on the company’s business model.

- **Financial Performance**: There are mixed opinions about the company’s ability to deliver sustainable profits in the future.

- **Long-Term Potential**: Despite the challenges, many investors believe that the company has strong long-term potential if it can navigate the current uncertainties.

These discussions highlight the complexity of investing in China Online Education Group stock. It’s important to consider multiple perspectives before making a decision.

Conclusion: What Should Investors Do?

In conclusion, the debates surrounding China Online Education Group stock are multifaceted and complex. From regulatory changes to financial performance, there are many factors to consider when evaluating the company’s prospects.

Here’s a quick recap of the key points:

- **Regulatory Landscape**: The government’s regulations could have a significant impact on the company’s business model.

- **Financial Performance**: While revenue growth has been impressive, profitability remains a concern.

- **Competition**: The online education market is highly competitive, and the company faces stiff competition from larger players.

- **Future Outlook**: The company’s ability to adapt to changing market conditions and regulatory requirements will be crucial in determining its success.

So, what should investors do? The key is to conduct thorough research and consider all the factors before making a decision. If you’re confident in the company’s ability to innovate and adapt, it could be worth taking a position. But if you’re unsure about the regulatory risks and financial performance, it may be wise to wait and see how things play out.

Don’t forget to leave your thoughts in the comments below! What’s your take on China Online Education Group stock? And if you found this article helpful, feel free to share it with your friends and colleagues. Let’s keep the conversation going!

Table of Contents

- Understanding China Online Education Group Stock

- Key Drivers of Growth in the Online Education Market

- The Regulatory Landscape: A Double-Edged Sword

- Financial Performance: The Numbers Don’t Lie

- Competition in the Online Education Space

- Market Trends and Future Outlook

- Investor Sentiment: What Are People Saying?

- Conclusion: What Should Investors Do?

Detail Author:

- Name : Dr. Valentina Heathcote

- Username : noemie73

- Email : ncartwright@gmail.com

- Birthdate : 1977-02-19

- Address : 7006 Turcotte Mission Lake Amariton, DE 56562-7370

- Phone : (484) 969-2100

- Company : Koelpin LLC

- Job : Title Searcher

- Bio : Ea dolorem non ex quia. Et tempore ea dignissimos veniam eveniet debitis.

Socials

twitter:

- url : https://twitter.com/bernhardg

- username : bernhardg

- bio : Et aliquam esse autem reiciendis ipsum deleniti omnis. Tempora molestiae dolores eos tempore facilis rerum. Magni et commodi praesentium delectus a sed est.

- followers : 5266

- following : 845

tiktok:

- url : https://tiktok.com/@guido.bernhard

- username : guido.bernhard

- bio : Itaque eius quo iste. Eos eligendi cum ad neque expedita est sit quaerat.

- followers : 6725

- following : 1569

linkedin:

- url : https://linkedin.com/in/guido_real

- username : guido_real

- bio : Id ad maxime aut laudantium asperiores autem ea.

- followers : 4974

- following : 2120

instagram:

- url : https://instagram.com/guido.bernhard

- username : guido.bernhard

- bio : Aut quia ut dolor commodi. Consectetur tenetur voluptatem sed impedit.

- followers : 1507

- following : 98

facebook:

- url : https://facebook.com/guido841

- username : guido841

- bio : Quia sequi quasi temporibus est temporibus id.

- followers : 6614

- following : 1910