What Are The Key Debates On Alibaba Group Holding Limited Stock?

Alibaba Group Holding Limited stock has been a hot topic among investors, analysts, and tech enthusiasts alike. Whether you're a seasoned investor or just starting to explore the world of stocks, understanding the debates surrounding Alibaba is crucial. This article will dive deep into the key discussions, breaking down the pros and cons, risks, and opportunities tied to Alibaba's stock. Let's get started, shall we?

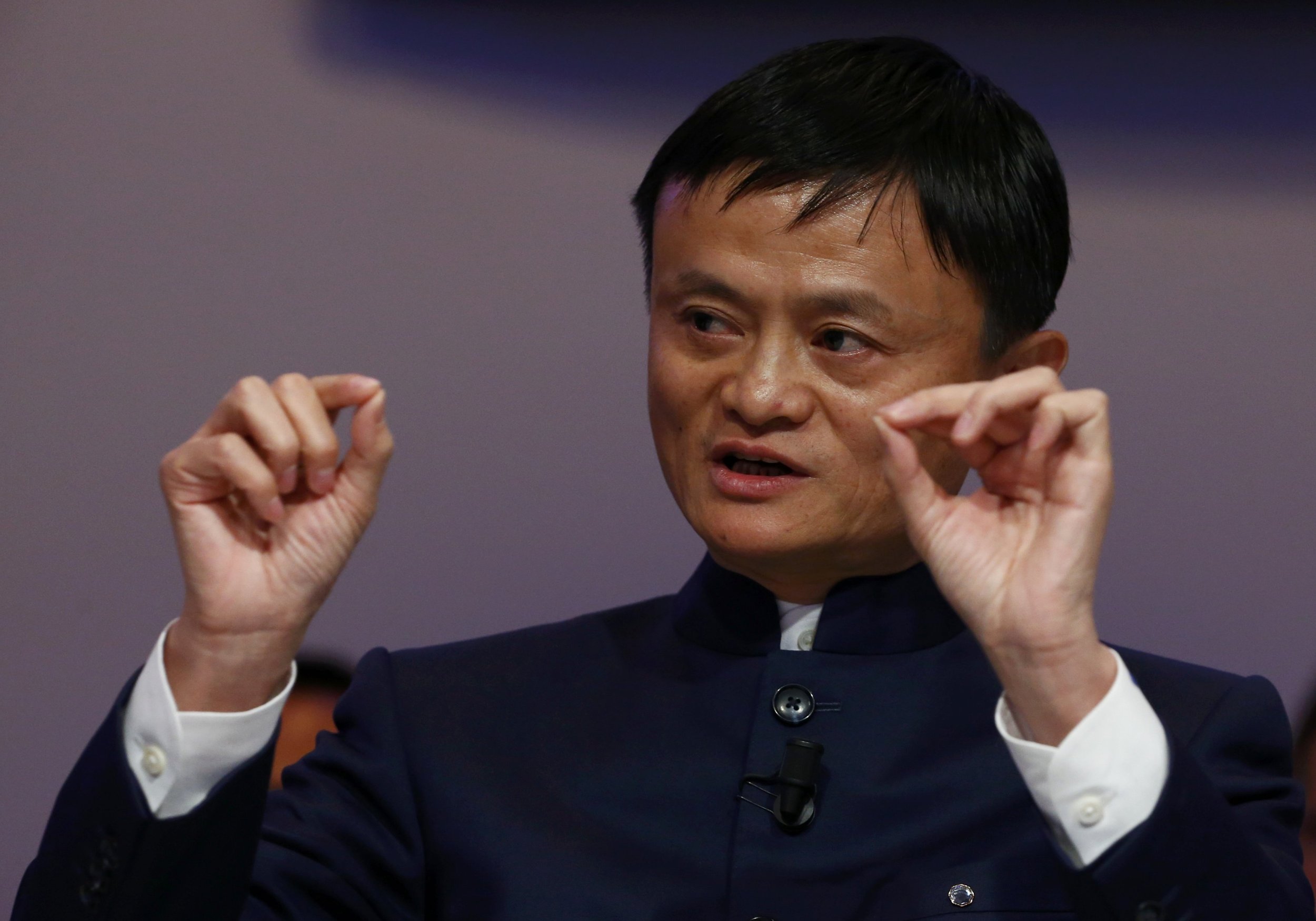

When it comes to tech giants, Alibaba is a name that demands attention. Founded in 1999 by Jack Ma and a group of 17 other visionaries, Alibaba has grown from a simple e-commerce platform into a sprawling empire with fingers in almost every pie imaginable. From cloud computing to fintech, Alibaba's influence is undeniable, and its stock performance reflects this complexity. But hold up—before you jump on the Alibaba train, there are some serious debates you need to be aware of.

Investing in Alibaba isn't just about buying shares and hoping for the best. It's about understanding the global market dynamics, geopolitical tensions, and internal challenges that could impact your portfolio. This article aims to shed light on these debates, helping you make informed decisions. So, buckle up, because we're about to break it all down for you!

- Am I Royalty Last Name Unlocking The Secrets Of Your Family Tree

- Andrew Coyne Family A Closer Look At The Man Behind The Words

Table of Contents

1. A Quick Background on Alibaba Group Holding Limited Stock

2. Regulatory Challenges: The Elephant in the Room

3. Growth Potential: Is Alibaba Still a Golden Goose?

- Elite Newspaper Your Ultimate Source For Trusted And Indepth News

- Is Deji Laray Married The Untold Story Behind The Rising Star

4. Competition in the Tech Space: Who's Beating Alibaba?

5. Geopolitical Risks: The U.S.-China Trade Tensions

6. Financial Performance: What Do the Numbers Say?

7. Innovation and Diversification: Alibaba's Secret Sauce

8. Sustainability Concerns: Is Alibaba Walking the Green Path?

9. What Investors Are Saying: The Good, the Bad, and the Ugly

10. Looking Ahead: What's Next for Alibaba Stock?

Conclusion: Should You Jump on the Alibaba Bandwagon?

A Quick Background on Alibaba Group Holding Limited Stock

Let's rewind for a sec. Alibaba Group Holding Limited (ticker: BABA) is one of the biggest names in the global tech scene. Headquartered in Hangzhou, China, Alibaba operates a wide range of businesses, including e-commerce platforms like Taobao and Tmall, cloud computing services through Alibaba Cloud, and even ventures in media and entertainment. Its stock was first listed on the New York Stock Exchange (NYSE) in 2014, making it one of the largest IPOs in history.

But why all the fuss about Alibaba's stock? Well, for starters, it's one of the few Chinese companies that have managed to penetrate the global market successfully. However, this success hasn't come without its fair share of challenges. The debates around Alibaba's stock revolve around its regulatory environment, growth potential, competition, and financial health. So, let's break these down one by one.

Regulatory Challenges: The Elephant in the Room

One of the biggest debates surrounding Alibaba's stock is the regulatory landscape in China. In recent years, the Chinese government has cracked down on big tech companies, including Alibaba. This crackdown has led to increased scrutiny and stricter regulations, which have had a significant impact on Alibaba's operations and stock performance.

For instance, in 2021, Alibaba was fined a whopping $2.8 billion by Chinese regulators for anti-competitive practices. This fine sent shockwaves through the stock market, causing Alibaba's share price to plummet. While the company has since taken steps to comply with regulations, the fear of future fines and restrictions lingers in the minds of investors.

Key Regulatory Issues

- Data Privacy: With the implementation of China's Personal Information Protection Law (PIPL), Alibaba faces increased pressure to safeguard user data.

- Antitrust Laws: The Chinese government has been cracking down on monopolistic practices, which could impact Alibaba's dominance in the e-commerce space.

- Censorship: As a media and entertainment company, Alibaba must navigate the delicate balance between free expression and government censorship.

Growth Potential: Is Alibaba Still a Golden Goose?

Despite the regulatory challenges, many investors remain bullish on Alibaba's growth potential. The company continues to expand into new markets and diversify its revenue streams, which could drive future growth. For instance, Alibaba Cloud has been growing at a rapid pace, positioning the company as a major player in the global cloud computing market.

However, not everyone is convinced. Some analysts argue that Alibaba's growth is slowing down, citing intense competition from domestic rivals like JD.com and Pinduoduo. Additionally, the economic slowdown in China could impact consumer spending, which would, in turn, affect Alibaba's e-commerce business.

Factors Driving Growth

- Expansion into Emerging Markets: Alibaba is aggressively expanding into Southeast Asia and other emerging markets, which could provide new growth opportunities.

- Diversification: By diversifying its revenue streams, Alibaba is reducing its reliance on e-commerce, making it less vulnerable to market fluctuations.

- Innovation: Alibaba's commitment to innovation, particularly in AI and cloud computing, could give it a competitive edge in the long run.

Competition in the Tech Space: Who's Beating Alibaba?

Let's face it—Alibaba isn't the only game in town. The tech space is highly competitive, and Alibaba faces stiff competition from both domestic and international players. In China, JD.com and Pinduoduo have been gaining market share, while globally, companies like Amazon and Google are expanding their presence in Asia.

So, how does Alibaba stack up against its competitors? While Alibaba still holds a significant share of the Chinese e-commerce market, its rivals are closing the gap. JD.com, for instance, has been investing heavily in logistics and supply chain management, which could give it an edge over Alibaba in terms of delivery speed and efficiency.

Key Competitors

- JD.com: Known for its strong logistics network and focus on premium products.

- Pinduoduo: Offers a social commerce model that appeals to budget-conscious consumers.

- Amazon: With its global reach and robust infrastructure, Amazon poses a significant threat to Alibaba's international expansion.

Geopolitical Risks: The U.S.-China Trade Tensions

Another major debate surrounding Alibaba's stock is the geopolitical risks associated with its operations. As a Chinese company listed on the NYSE, Alibaba is caught in the crossfire of the U.S.-China trade tensions. These tensions have led to increased scrutiny of Chinese companies by U.S. regulators, which could impact Alibaba's ability to access the U.S. capital markets.

Additionally, the ongoing tech war between the U.S. and China could limit Alibaba's ability to collaborate with U.S.-based companies, potentially stifling innovation. While Alibaba has been taking steps to mitigate these risks, the uncertainty remains a major concern for investors.

Financial Performance: What Do the Numbers Say?

When it comes to financial performance, Alibaba's numbers are impressive. In the fiscal year 2023, the company reported revenue of $120 billion, up 10% from the previous year. However, profit margins have been shrinking due to increased investments in new initiatives and regulatory fines.

Analysts are divided on whether Alibaba's current valuation is justified. While some argue that the company's diverse revenue streams and strong market position warrant a premium valuation, others believe that the risks associated with its operations justify a more conservative approach.

Key Financial Metrics

- Revenue: $120 billion in FY 2023

- Net Income: $7.9 billion in FY 2023

- Market Cap: Approximately $250 billion as of 2023

Innovation and Diversification: Alibaba's Secret Sauce

One of Alibaba's key strengths is its commitment to innovation and diversification. The company has been investing heavily in AI, cloud computing, and other cutting-edge technologies, which could give it a competitive edge in the long run. Additionally, Alibaba's ventures into media and entertainment have helped diversify its revenue streams, reducing its reliance on e-commerce.

However, innovation comes at a cost. Alibaba's heavy investments in new technologies and businesses have put a strain on its profit margins, which has raised concerns among some investors. Nevertheless, the company's long-term vision and strategic investments could pay off in the future.

Sustainability Concerns: Is Alibaba Walking the Green Path?

As the world becomes increasingly focused on sustainability, companies like Alibaba are under pressure to adopt greener practices. Alibaba has made commitments to reduce its carbon footprint and promote sustainable development, but some critics argue that these efforts are not enough.

In 2021, Alibaba launched the "Carbon Neutrality Action Plan," which aims to achieve carbon neutrality across its operations by 2030. While this is a step in the right direction, the company still has a long way to go in terms of implementing sustainable practices across its entire supply chain.

What Investors Are Saying: The Good, the Bad, and the Ugly

So, what do investors think about Alibaba's stock? The opinions are mixed. Some investors are bullish on Alibaba, citing its strong market position, diverse revenue streams, and commitment to innovation. Others, however, are more cautious, pointing to the regulatory risks, intense competition, and shrinking profit margins.

One thing is clear: investing in Alibaba's stock is not for the faint of heart. It requires a deep understanding of the company's operations, the regulatory environment, and the global market dynamics. For those willing to take the risk, the potential rewards could be significant.

Looking Ahead: What's Next for Alibaba Stock?

The future of Alibaba's stock is uncertain, but one thing is certain: the company will continue to play a major role in the global tech landscape. With its diverse portfolio of businesses and commitment to innovation, Alibaba is well-positioned to navigate the challenges and opportunities ahead.

However, the road ahead is not without its hurdles. Regulatory challenges, geopolitical risks, and intense competition will continue to test Alibaba's resilience. Investors who are willing to take the long-term view and ride out the short-term volatility could be rewarded with significant gains.

Conclusion: Should You Jump on the Alibaba Bandwagon?

In conclusion, the debates surrounding Alibaba Group Holding Limited stock are complex and multifaceted. While the company's growth potential and innovative spirit make it an attractive investment, the regulatory challenges, geopolitical risks, and intense competition cannot be ignored.

Before investing in Alibaba's stock, it's essential to weigh the pros and cons carefully. If you're willing to take the risks and have a long-term investment horizon, Alibaba could be a worthwhile addition to your portfolio. However, if you're risk-averse or looking for quick gains, you might want to think twice.

So, what's your take on Alibaba's stock? Leave a comment below and let us know your thoughts. And don't forget to share this article with your friends and fellow investors. Until next time, happy investing!

Detail Author:

- Name : Eliseo Walsh

- Username : reece41

- Email : grady.jasen@hotmail.com

- Birthdate : 1986-03-19

- Address : 69307 Berge Lodge West Christophe, MN 96834-1217

- Phone : 1-757-990-0744

- Company : Willms Ltd

- Job : Rolling Machine Setter

- Bio : Voluptatem exercitationem sed velit facere vel et. Officia quos qui aliquam. Amet dolores praesentium deleniti maxime non et totam.

Socials

instagram:

- url : https://instagram.com/bashirian2013

- username : bashirian2013

- bio : Quae dolor sed ab ut et. Eaque et doloremque et optio ut. Non omnis ut velit qui amet sint.

- followers : 1752

- following : 2885

twitter:

- url : https://twitter.com/kaitlyn_id

- username : kaitlyn_id

- bio : Et est laudantium qui non. Sit aut vitae adipisci quis temporibus ex quod. Qui consequatur aut minima nobis ut est.

- followers : 3623

- following : 2856

tiktok:

- url : https://tiktok.com/@kaitlyn.bashirian

- username : kaitlyn.bashirian

- bio : Soluta ea iure assumenda voluptas fugiat explicabo.

- followers : 1626

- following : 1590

facebook:

- url : https://facebook.com/kaitlyn_dev

- username : kaitlyn_dev

- bio : Quo eligendi amet non quisquam ipsum praesentium in.

- followers : 1986

- following : 525